Will Goog Become a 2000 Stock Again

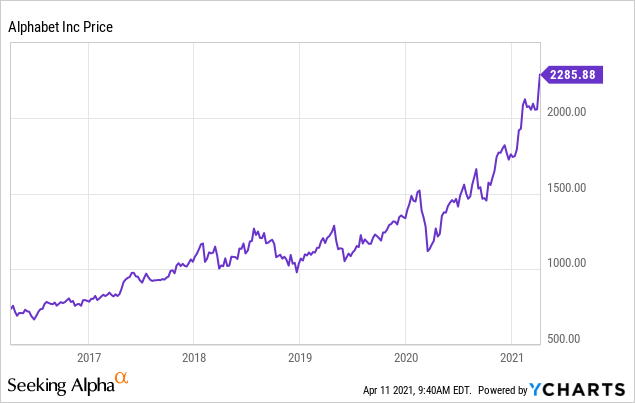

With a share price over $2000, speculation is rising that Alphabet, Inc. aka Google (NASDAQ:GOOG) (NASDAQ:GOOGL) could denote a stock split old in 2021. Google has split up the shares before, so in that location is precedent, although the reasons for the prior split were non exactly straightforward.

Google'due south stock split history

Google announced its start and only split in early 2012. It was not an ordinary divide and involved Google creating a new, non-voting class "C" of shares, which trade nether the Google (GOOG) ticker, that would be distributed to owners of the class "A" shares, which trade equally Google (GOOGL), besides as to the owners of class "B" shares.

Course "B" shares are a super-voting share class that receives 10 votes per share, compared to 1 vote per share for course "A". The "B" shares are not publicly traded and are primarily held past co-founders Sergey Brin and Larry Folio, equally well as former CEO Eric Schmidt.

By distributing a new, non-voting share grade to both "A" and "B" holders, this provided a style for the grade "B" holders to sell or donate some of their shares (past selling the new, non-voting "C" shares) while retaining full voting command in the visitor.

Google shareholders filed a lawsuit that this was not in shareholders' best interest, but this was settled in late 2013, with the split finalizing on March 27, 2014.

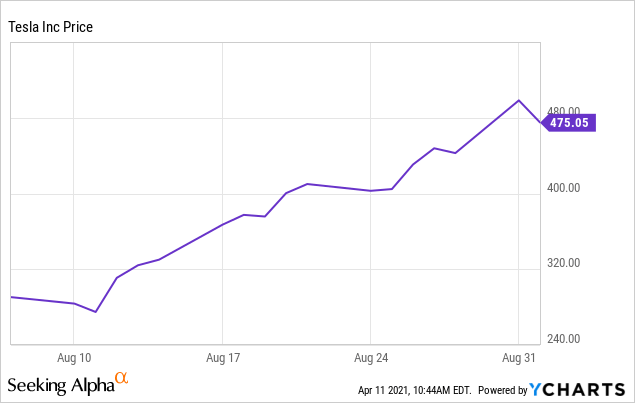

Is the stock fairly valued? How should investors approach valuation for Google shares?

With the benefit of hindsight, Google shares really looked cheap every bit recently as last September/October when shares were in the $1500 range. Even after a fifty% run, I still don't encounter the shares every bit overvalued considering the quality of their business and projected growth rates. Google remains a marketplace leader with an extraordinarily deep moat and should command a premium multiple because of it.

Equally I described in my commodity comparing Amazon (AMZN) to Google, I believe Google'south earnings are understated due to its massive investments into Google Cloud and "Other Bets". Google had $41 billion in operating earnings in 2020, but that included a $5.vi billion loss in Google Cloud and a $4.5 billion loss in "Other Bets", which are a transformational collection of businesses, including Waymo self-driving cars.

Even without making whatsoever special adjustments for Google Deject and Other Bets, Google seems fairly valued at current levels. Adjusting for these, which I think is advisable, suggests Google to be somewhat undervalued.

Will Google's stock split again?

The historic reason for stock splits was "to make shares more attractive to a broader pool of investors." Historically, there were additional fees, chosen odd lot fees, for modest purchases typically nether 100 shares. Today, some investors are unable to beget purchasing even a single share of a stock trading in the thousands. Just odd lot fees are a affair of the past, and many brokerages offer fractional trading for companies like Google that have higher share prices.

While partial trading does make owning expensive stocks a possibility for smaller investors, Google's farthermost share price does effectively prohibit many smaller investors from using options. Selling covered calls is a popular income generation strategy for many investors, simply to exercise so with Google requires 100 shares, which at the current price is over $220,000 worth.

Information technology's truthful that share splits do zippo to increase the intrinsic value of a company, since one share at $100 is the same as two shares at $50. But the NASDAQ recently found real benefits in better spreads, increased liquidity, and lower intraday volatility. Across this, even if the impact is mostly psychological, that doesn't brand information technology less real.

Many studies, including several by David Ikenberry, Chairman of the Finance Department at the Academy of Illinois at Urbana-Champaign, found price performance of split stocks outperformed the market significantly before and afterward the split. Similar research has been conducted in diverse markets around the world. While at that place is much fence on the magnitude of the touch, as well as how much selection bias is present, I take withal to see any report which has ended stock splits are a negative for share price.

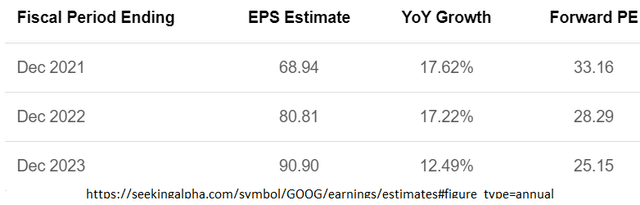

Recent examples, Apple tree (AAPL) appear a four-for-1 stock separate with their earnings on July 30th that became constructive August 28th. The stock rose significantly from the declaration to the carve up.

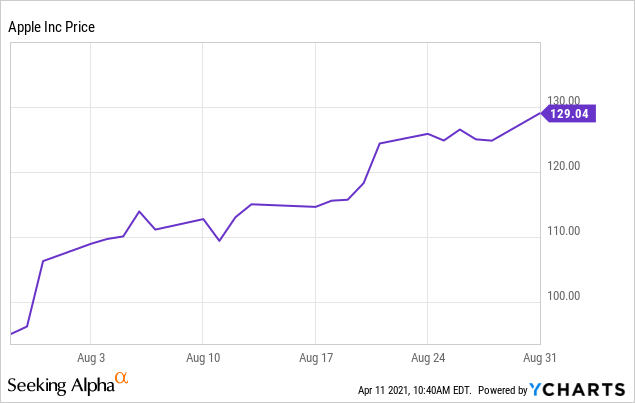

Tesla (TSLA) announced a 5-for-1 dissever on Baronial 11th that became effective on Baronial 31st. It nearly doubled by the time information technology split!

If Google split 5-to-1, seeing the shares rising 10-xx% would not surprise me at all.

Should Google carve up the stock?

If we accept the conclusions higher up that a stock split would be a positive for the share toll, why wouldn't Google move forward with information technology? The reason is that Google has been repurchasing a meaning corporeality of shares and is likely to continue to practise then in the future.

For companies like Tesla that accept been sellers of its ain shares, a college share price is a full positive. If a stock split acts as a positive catalyst for the share price, information technology makes sense for Tesla to practice. Just Google has been repurchasing a meaning corporeality of shares, $31.15 billion in 2020, up from $xviii.39 billion the previous year. For companies that are returning uppercase by repurchasing significant amounts of shares, doing and then at lower valuations is preferable.

Every bit an investor of a visitor that's repurchasing shares, is a college current share price a good or a bad thing?

This is a topic where I believe the "theoretical respond" and the "applied answer" diverge. Ultimately, the answer volition be unique to each investor depending on their personal situation and time horizon, which is what makes it catchy. For investors with a long fourth dimension horizon, a lower share price is vastly preferable, since the visitor can repurchase at a more bonny valuation. For investors with a shorter time horizon or those that may wish to diversify into other holdings, a higher share price may exist preferable.

Information technology's a complicated situation and every company seems to approach it differently. Apple has been repurchasing meaning amounts of shares for over a decade, but they still split the stock 7-1 in 2022 and 4-one last year.

Even for people similar Warren Buffett, the answer isn't straightforward. Berkshire Hathaway (BRK.A) (BRK.B) is now repurchasing a large corporeality of shares, and a higher share cost means that future repurchases are washed at less attractive valuations. But it besides means the shares Buffett has donated in the past to diverse charities, including the Gates Foundation, can be sold for more coin.

Conclusion

Ultimately, I do not see Google splitting the stock in 2021. I believe the 2022 split was done primarily to permit Google insiders to sell shares but retain voting control in the company, so I don't think the past precedence here carries much weight.

Google co-founders Larry Folio (historic period 48) and Sergey Brin (historic period 47) still retain effective command of the company with over l% of the voting power, and electric current Google CEO Sundar Pichai is merely 48 years old. I believe they are all focused on long-term value creation and would similar Google to go on repurchasing shares at a reasonable valuation, and would non view Google'south share cost of a sudden appreciating stock carve up excitement as a positive.

That said, I still find Google to exist a solid long-term investment, even without a carve up as a most-term catalyst.

It's nevertheless a buy.

This commodity was written past

Individual investor and family role principal with over twenty years of investment experience. I favor fundamental analysis and look for individual bug and asset classes that are out of favor and correspond a skillful gamble/reward trade off. I oft utilise options strategies, covered calls on companies I own that have gotten alee of themselves, and writing puts on stocks that I'd like to own at lower prices.Educational background Finance MBA (NYU Stern) with Informatics undergraduate.

Disclosure: I/we accept no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this commodity myself, and it expresses my own opinions. I am not receiving bounty for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: https://seekingalpha.com/article/4418703-google-stock-split-again

Post a Comment for "Will Goog Become a 2000 Stock Again"